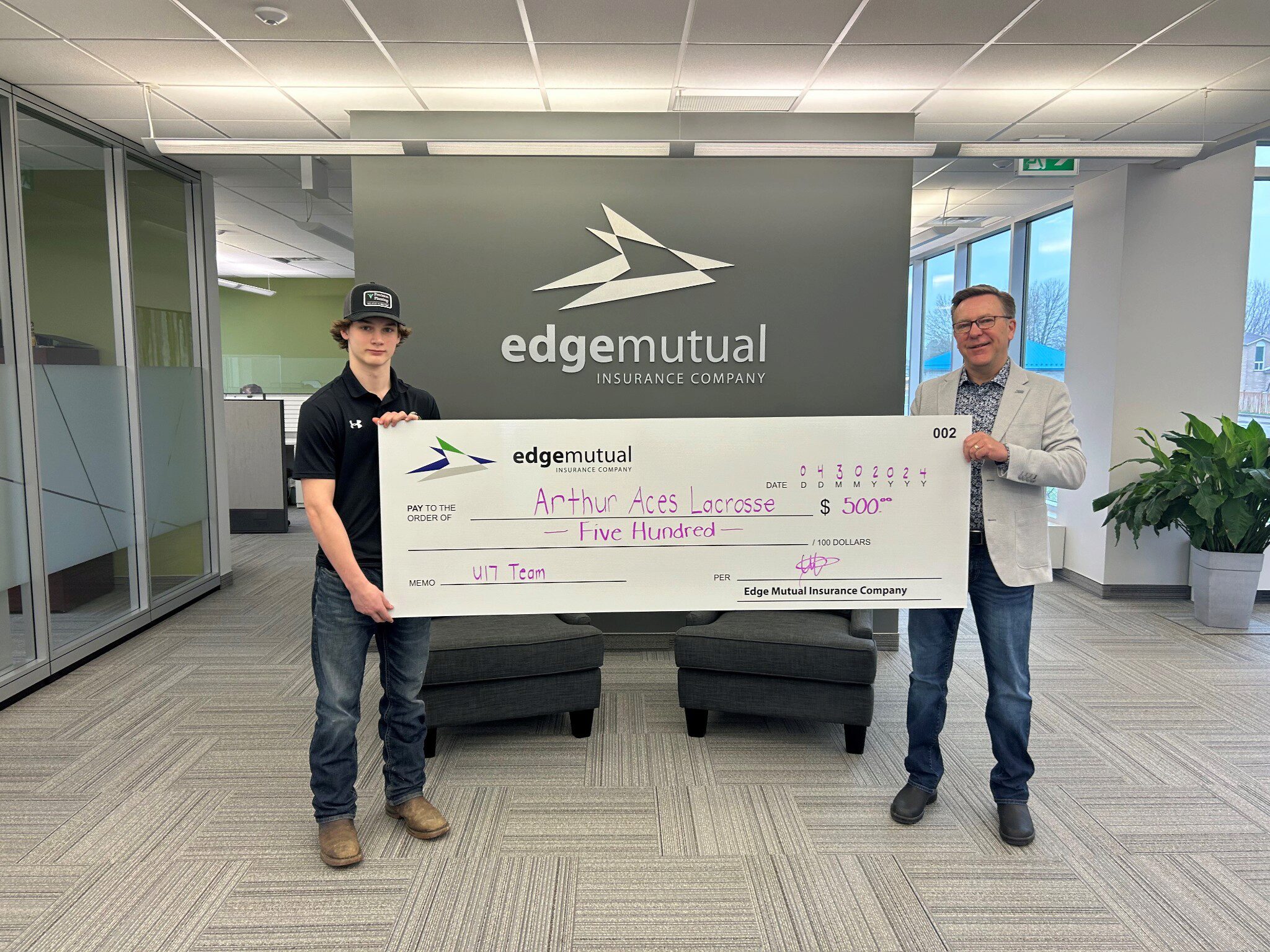

Just in time for the start of their 2024 season, Edge Mutual and two other sponsors pitched in to help with the Arthur Aces U17 lacrosse team's equipment expenses. Come on out this summer to show your support for our minor lacrosse league! Go Aces!

Read More

Edge Mutual in Your Community

Check out the latest information about Edge Mutual in your community along with other information and resources.